He says the best way to advance is by volunteering to work on various projects and decision-making tasks to increase your knowledge of the company and your role in its success. The contents of this book are very comprehensive and comparable to other Managerial Accounting texts I have used in the past from major publishers. All of the major subjects I expected to find in an introductory managerial text were listed. There were some subject areas that I felt could have been expanded, particularly with more introductory/context-building information, but overall, everything is included. The table of contents is missing from the pdf version of the text, but included in the online version; this is not a big draw back since the content could be covered “out of order” in a course, or students could be directed to the specific pages to read. One thing I would like to see is some expansion of the learning objectives.

Literature review

Our expert tax report highlights the important issues that tax preparers and their clients need to address for the 2024 tax year. Stay informed and proactive with guidance on critical tax considerations before year-end. CPAs who want to drive greater profitability and growth must understand customer acquisition costs and customer lifetime value.

Content Overview

Companies previously unfamiliar with financial constraints may find this a difficult part of management accounting. Management accountants can also create financial constraints that are too restrictive. Tight budgets or avoidance of necessary purchases can decrease the company’s ability to maximize profits.

Discover content

I can see how chapters in this book could supplement a traditional textbook for upper level undergraduate and MBA courses and supplement journal articles for more research‐based postgraduate courses. This section has chapters on EVA (Bouwens and Speklé), inter‐organizational relationships (Kraus and Lind), public‐private partnerships (Moll and Humphrey), and knowledge resources (Roberts). These chapters were some of the best in the book as they showed how management accounting is being adapted to deal with current business issues. While EVA is now covered to some extent in many conventional textbooks, the other areas represent potential new topic areas. The chapter by Roberts on knowledge resources is a good example of one of these new applications of management accounting. In this chapter, Roberts examines how knowledge resources develop within an organization and then explores some of the economic characteristics of knowledge.

Perceptions of the Ethical Infrastructure, Professional Autonomy, and Ethical Judgments in Accounting Work Environments

The third focal point of this study relates to the association of SMA techniques usage to organisational performance. Reviewed literature shows that organisations are achieving higher performance through the use of SMA techniques. In other words, effective use of SMA techniques would improve organisational performance. The plausibility in that performance outcome lies in the fact takt time vs cycle time vs lead time that organisations are able to utilise appropriate SMA measures to ensure effective, customer, competitor, strategic decision-making, costing, and planning and control orientation in their operational activities. Further on the performance point, literature also suggests that management control systems (MCS)–performance relationship is mediated by business strategy (e.g. [2]).

In terms of contents, the textbook covered all the major concepts of managerial accounting and hence, remain relevant for a considerable period of time. However, there are scopes for adding more examples and recent business phenomena and reference to current information technology. Although they are followed in a slightly different way and order than are pursued in the textbook I am currently using. Inclusion of Table of Contents in the PDF version would have assisted with the reviewing of the textbook. A comprehensive list of learning objective would be useful at the beginning of each chapter. In addition, inclusion of an index/glossary would have been really helpful for quick search.

- Examples used in the chapter text lend themselves to being used a guides when students work on assigned problems from the end every chapter.

- If I had one prediction to make for 2022, it is that there will be more uncertainty and risk.

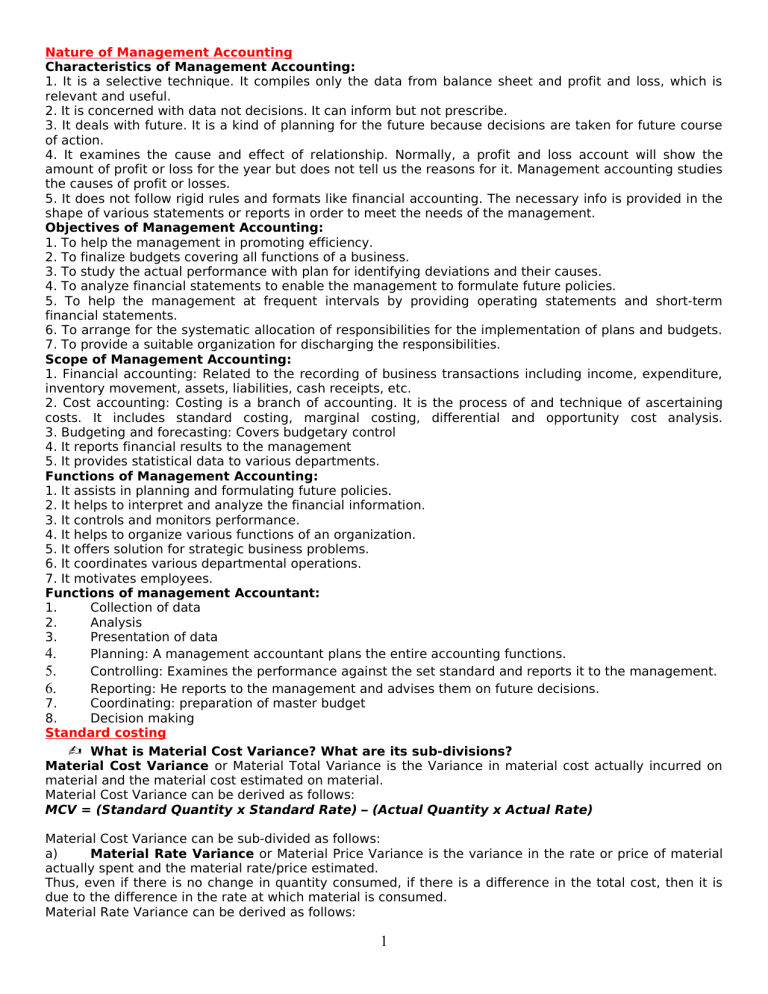

- A separate practice known as managerial accounting refers to the discipline of record-keeping with an eye towards budgeting and performance measurement, typically conducted by managers.

- This information is used to prepare income statements, cash flow statements, and balance sheets, In smaller firms, you may end up performing these tasks yourself.

You can earn this designation if you complete a bachelor’s degree, pass the two-part CMA exam, and acquire two continuous years of professional experience in management accounting or financial management. In business, financial accounting refers to the act of recording a company’s financial transactions, which are typically examined by investment banking analysts and shareholders of public corporations. A separate practice known as managerial accounting refers to the discipline of record-keeping with an eye towards budgeting and performance measurement, typically conducted by managers.

Table 1 shows a sample of selected literature covered in this piece of research, pinpointing clearly the focus, context of the studies and findings from the studies. The median annual salary for accountants and auditors in 2023, according to the Bureau of Labor Statistics. Although the Bureau of Labor Statistics (BLS) does not differentiate between different accountants, it does report salary expectations for accountants—along with auditors—in general.

Part 2 of the book examines the so‐called “new” management accounting techniques such as ABC (Major), BSC (Nørreklit and Mitchell), strategic investment appraisal (Northcott and Alkaraan), strategic management accounting (Lord) and performance measurement (Fitzgerald). Each of these chapters reviews and critiques the research on the technique and explains how and/or why they are used in practice. I found the reviews and critiques to be limited in some chapters such as the ones on strategic management accounting, ABC and the BSC but this was probably due to the amount written on these areas in the accounting literature.

As demand for ESG data grows, so does the opportunity for accountants to help businesses meet reporting requirements. The quarterly survey of U.S. business and industry leaders shows a decline in optimism about the next 12 months related to the domestic economy. Respondents also were asked about the effect of election uncertainty on business forecasting and about the effect of a potential lowering of interest rates. Most senior executives are pleased by the impact of moving their supply chains closer to home, according to a KPMG report. Learn four keys to considering whether a change would benefit your company. You need to be persuasive and convincing and be educated in both human capital management and financial capital management, according to Lon Searle, former CFO of YESCO Franchising LLC.

They prepare data—recording and crunching numbers—that their companies use for budgeting and planning purposes. They are also responsible for managing risk, planning, strategizing, and decision making. Other duties include supervising lower-level staff, identifying trends and opportunities for improvement. Mulling adds that while the typical management accountant possesses a bachelor’s degree in accounting or finance, your degree doesn’t have to be in one of these subjects to obtain a Certified Management Accountant (CMA) certification.